Thesis:

On this last dip, I scooped up some additional AIOZ and JASMY at the below prices. These were hit the hardest and took out their April lows, therefore, theoretically they have a larger percentage to take back (more potential gains):

AIOZ : $0.1702 (11/3 ✅) , $0.1602 (11/3 ✅), $0.1502 (11/6 ✅) : $0.1103 (11/21 ✅) Current Bottom $0.1065 (11/21)

JASMY: $0.00871 (11/4 ✅) , $0.00824 (11/4 ✅), $0.00797 (11/4 ✅), $0.00797 (11/20 ✅): Current Bottom $0.00654 (12/2)

Bitcoin has dropped lower than we hoped, with the current bottom sitting at $80,600. Because of this, I am now going to be looking to take 15% off my Alts when BTC hits 108,800-$116,500. Regardless of where my Alts are at on their own price charts. This is the “danger zone” for BTC and it’s where typically traders get trapped and price rolls back over. Because of this recent drop, the probability increases that this is distribution (the top) for BTC, but I’m still in full belief it will see new highs. The higher time frame (macro) is still in tact as long as we don’t close below $74,500 (the previous macro low, which would create a lower low). We just have to protect ourselves from further downside.

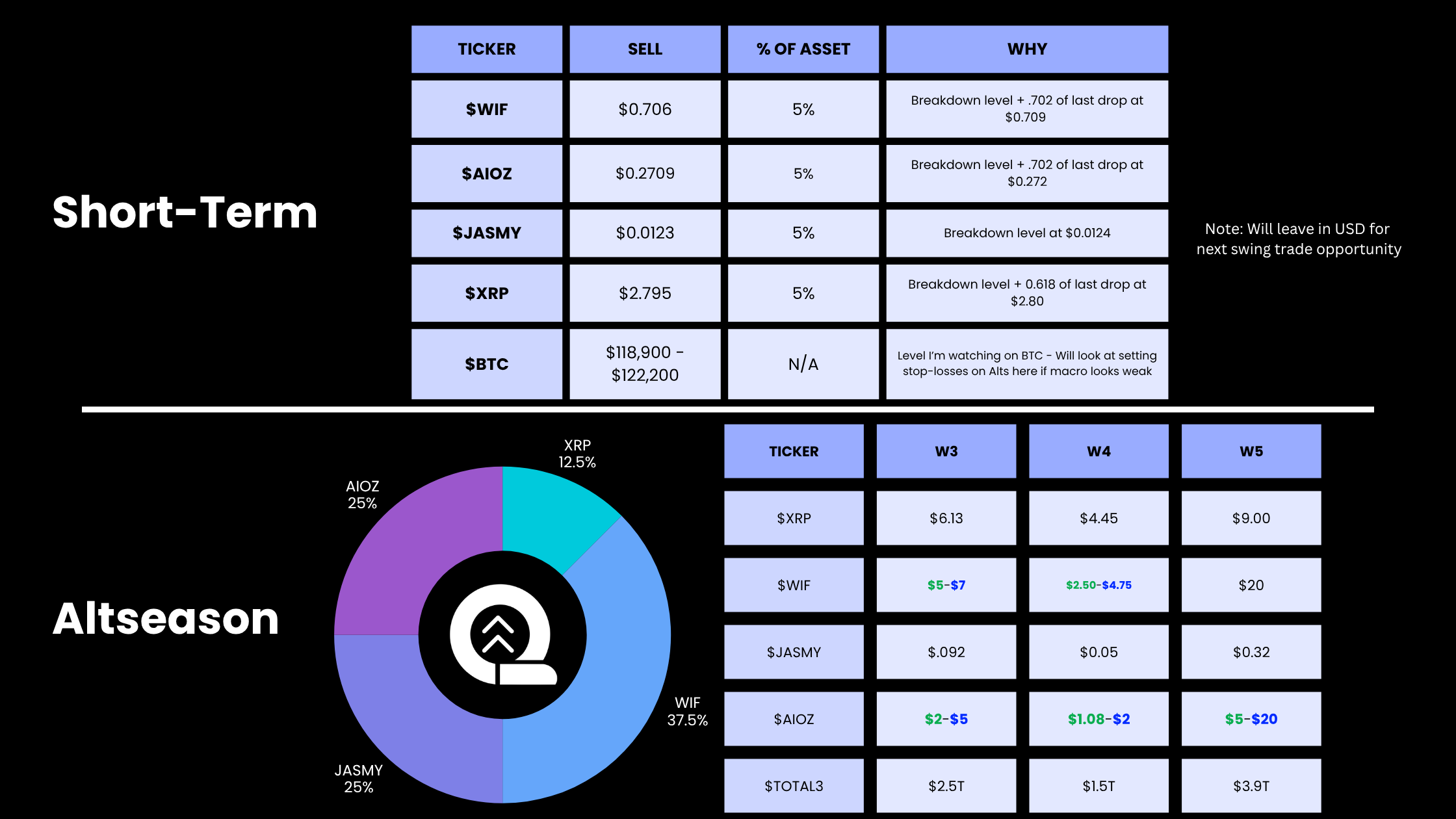

I still have 5% sell sets for each of my individual alts at their 10/10 breakdown level (see graphic at bottom of page) . The breakdown levels typically at minimum get backtested, so we’ll take a small amount off there. All in, when BTC gets up around $117K, I’ll have 20% of my bags sold. Again, I’m still in the camp that BTC sees one more high up around $155K. The below photo shows that the fractal from September 2023 until right now December 2025 is practically identical to the first five waves from the bottom of late 2022. That fractal actually double bottomed, which would be equivalent to BTC dropping to $74,500 right now. These fractals often repeat themselves on the way up, just with different magnitudes. So if we’ve seen two of those fractals (Wave 1, Wave 3), what are we missing? A final fractal that would coincide with a final Wave 5.

My point of all this is nothing is broken — people are just getting emotional. The data doesn’t show that this is the end. ESPECIALLY when you take into consideration how hammered the Fear & Greed Index is. This is at All-Time lows, as BTC drops and finds a bottom. The below chart shows the Fear & Greed score at each of the Macro BTC bottoms in the last 7 years. Our low was a 10, which has been lower than all prior bottoms up until this point, including the Covid-19 crash.

The Bitcoin Dominance ($BTC.D) shows that we’re just waiting on a drop. We’ve been flirting with the exact breakdown level from our other two Altseasons (60.73%). Structurally, everything is there for this chart to crash and at minimum, take us down to the high 40%s where you can see the 2021/2022 tops (green box). My base is a drop into the yellow box to potentially take out those lows around 39%. When this starts moving down it does so violently, as has been shown in the past Altseasons (orange boxes). Right now we’ve been dropping, but it’s been alts dropping less than BTC. It hasn’t really been Alts APPRECIATING while BTC also appreciates. That’s when the true Altseason will start. Many of you haven’t been through one yet - you won’t have to ask as it’s happening, you’ll see the mania.

Obviously, we have to discuss $ETH, King of the Alts and typically the first to move. The ETH/BTC chart looks extremely ripe. In August, we tested the upper trendline dating back to mid 2022 and got rejected. It certainly looks like we’re completing a wave 4 before a final wave 5 up. My target is the 0.08 level (green box). We’ve not only seen price get stopped out there a ton in the past, but it also coincides with the 0.5 Fib of the entire range dating back to 2017. The Daily chart also shows we’ve just been stuck in a downtrend channel since that August top. When these trendlines break, I expect the move to be violent. We even see that on Waves 1 & 3 on the Weekly chart.

These markets are primed. The hardest part is everyone’s favorite question “When”? It hasn’t been a fun year, but we’re earning our stripes and a turnaround is seemingly very close. As i’ve mentioned many times, the real Altseason move typically only happens in 6-8 weeks. Once the train leaves the station, we’re on notice. I’ve shown a lot of different data that tells us that there is some terrible downside coming. But terrible downside doesn’t typically come without a euphoric, blow-off top. And that’s what I believe is brewing.

For a deeper analysis, take a look at the video I put together on my updated thesis: